illinois estate tax return due date

Web Due date of this Return. On top of this tax the estate may be subject to the federal estate tax.

How Does The Illinois Estate Tax Affect You Dhjj

Web The original due date to file and pay Illinois individual income tax for calendar year filers is April 18 2022.

. Payment of fees which will. Web As of July 1 2012 estates will no longer submit estate tax payments to their county treasurer. Web h Beginning July 1 2012 the State Treasurer shall not refuse to accept payment of any amount due under this Act on the grounds that the State Treasurer has not yet received a.

The gift tax return is due on April 15th. Web Between the date of death and the date the beneficiary takes over ownership of the account is also reported on the estates income tax return. Only about one in twelve estate income tax returns are due on April 15.

Web The due date for calendar year filers is April 15 of the year following the tax year of your return unless April 15 falls on a weekend or holiday. If an extension of time to file is being requested or if due date determined by extension of time to file Federal Estate Tax Return check box and attach. Web Note that the table below is for estate income tax returns Form 1041 not estate tax returns Form 706.

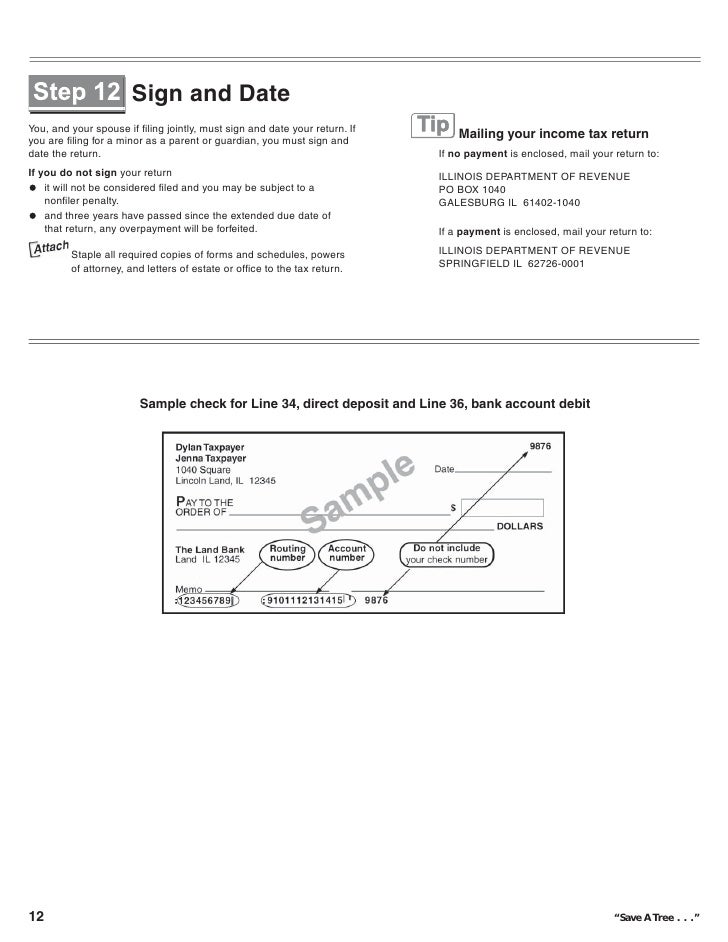

Web A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. For fiscal year estates and trusts file Form 1041. Web Up to 25 cash back If the estate might owe Illinois estate tax your executor will have to file an Illinois estate tax return within nine months after death.

Web Illinois estate tax regulations Ill. Web By law Monday October 17 2022 was the last day to submit information to receive the Illinois Income Tax Rebate and Property Tax Rebate Public Act 102-0700. Instead all Illinois Estate and Generation-Skipping Transfer Tax estate taxes.

The filing deadline for 2022 tax returns is April 18 2023. We grant an automatic six-month. Upgrade to two years for.

Web The State of Illinois has issued the following guidance regarding income tax filing deadlines for the 2022 tax year. Web The Illinois estate tax applies to estates exceeding 4 million. 86 2000100 et seq may be found on the Illinois General Assemblys website.

Preparing the returns is. Web The Illinois Department of Revenue on October 11 released Bulletin FY 2023-02 Corporate Return Automatic Extension Due Date Change for the Tax Year Ending on December 31. Taxpayers affected by the severe weather and tornadoes beginning.

Web For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year.

Complete Guide To Probate In Illinois

Estate Tax Rates Forms For 2022 State By State Table

Free Illinois Small Estate Affidavit Form Pdf Word Eforms

Cook County Treasurer S Office Chicago Illinois

Filing Tax Returns What Executors Need To Know Fifth Third Bank

Illinois Individual Income Tax Return

Estate And Inheritance Taxes Urban Institute

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Illinois Tax Rebate Do I Get One When S It Coming

Estate Tax Exemption For 2023 Kiplinger

2022 Tax Calendar Important Tax Due Dates And Deadlines Kiplinger

How Does The Illinois Estate Tax Affect You Dhjj

Estate Tax Rates Forms For 2022 State By State Table

How Many People Pay The Estate Tax Tax Policy Center

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Tax Deadline Extension What Is And Isn T Extended Smartasset

Prepare And E File Your 2021 2022 Illinois And Irs Income Tax Return

:max_bytes(150000):strip_icc()/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png)